A Line of Credit that businesses can depend on

Our line of credit gives your business continuous access to working capital when your business needs it the most.

What Is a Line of Credit?

Flexible Payments*

Automatic daily, weekly, or monthly payments are withdrawn from the business bank account, and the business only pays back the amount drawn plus any interest or other fees that may be charged.

Term Options*

Amortization from 3–18 months (the term may reset every time you draw capital)

Cost and Fees*

An interest charge or fixed fee will be charged, other fees may also be charged

Easy Access to Funds†

Your Rapid Finance Business Line of Credit allows you to access your funds either via an ACH to your business bank account, or almost instantly draw funds to the Rapid Access Card† associated with your Line of Credit account.

A line of credit is a flexible financing option that allows quick access to a defined amount of working capital. The way it works is a business is approved for a set amount of credit and has access to that amount through a streamlined process which allows for easy access to drawing on the approved amount when needed. The full amount does not need to be drawn at one time, your business can conveniently draw on as much or as little working capital as it needs, up to the approved amount. Businesses are only responsible for repaying the funds they used, plus any interest or other fees that may be charged.

Rapid Finance’s line of credit is extremely flexible and gives your business access to the working capital it needs, when it needs it most. As mentioned, a business line of credit is ideal for repeat cash flow needs. It’s also a great option for obtaining working capital to pay for unexpected expenses or exciting new business opportunities. Rapid Finance offers and facilitates access to financing from $5,001 up to $250,000*. Best of all, the amortization terms can vary from three to eighteen months*. Payments on the outstanding balance can be made with fixed daily, weekly, or monthly payments that are automatically withdrawn from the business bank account on file*.

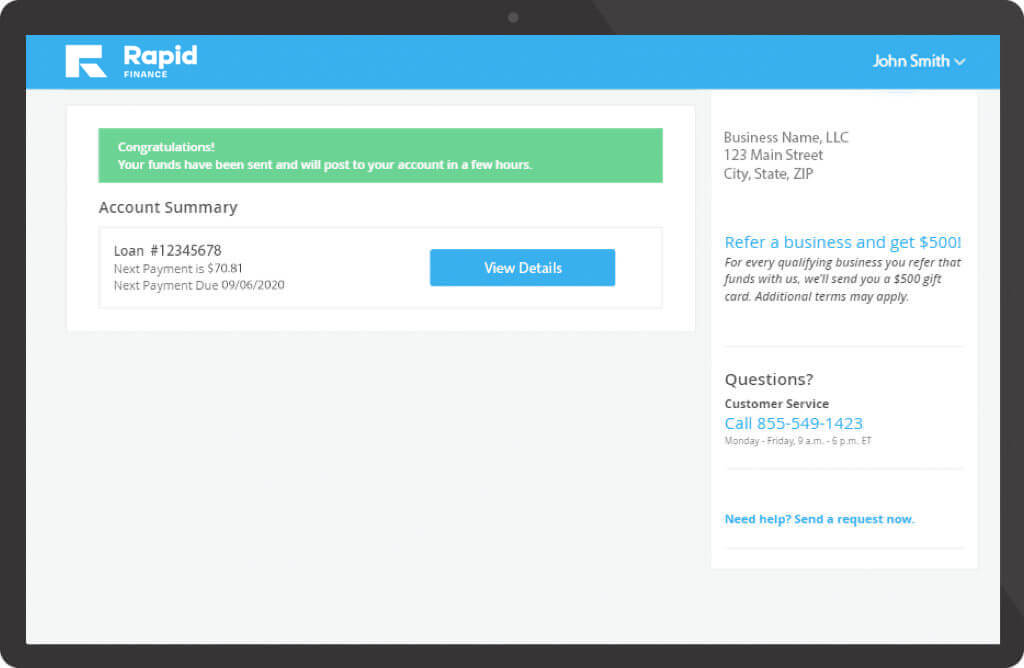

Rapid Finance’s line of credit provides the flexibility to access funds through ACH deposits into your business bank account, or with the Rapid Access Prepaid Mastercard® linked to your account. Your Rapid Access Card† will be linked to your line of credit account and gives you and your business easy and near real-time access to the funds available on your line of credit account. Your business also benefits from having a secure payment method that can be used everywhere Mastercard® is accepted. Review our FAQs to learn more about the Rapid Access Card†.

† Rapid Access Prepaid Mastercard® is linked to Rapid Finance Business Line of Credit account and subject to approval and availability to eligible customers that are in good standing. The Rapid Finance Business Line of Credit is not a SoFi Bank product or service. All loans are funded and originated by Rapid Finance and are not affiliated with SoFi Bank. Additional terms and conditions may apply. The Rapid Access Prepaid Mastercard is issued by SoFi Bank, N.A. Member FDIC, pursuant to license by Mastercard International Incorporated and can be used everywhere Mastercard is accepted. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Notify us immediately at 866-432-7689 if your card is lost or stolen.

A Business Line of Credit Grants Continuous Access to Working Capital When You Need It Most

You only need 3 important things to apply.

A valid form of identification

Business bank account number and routing

Last three months of business bank statements

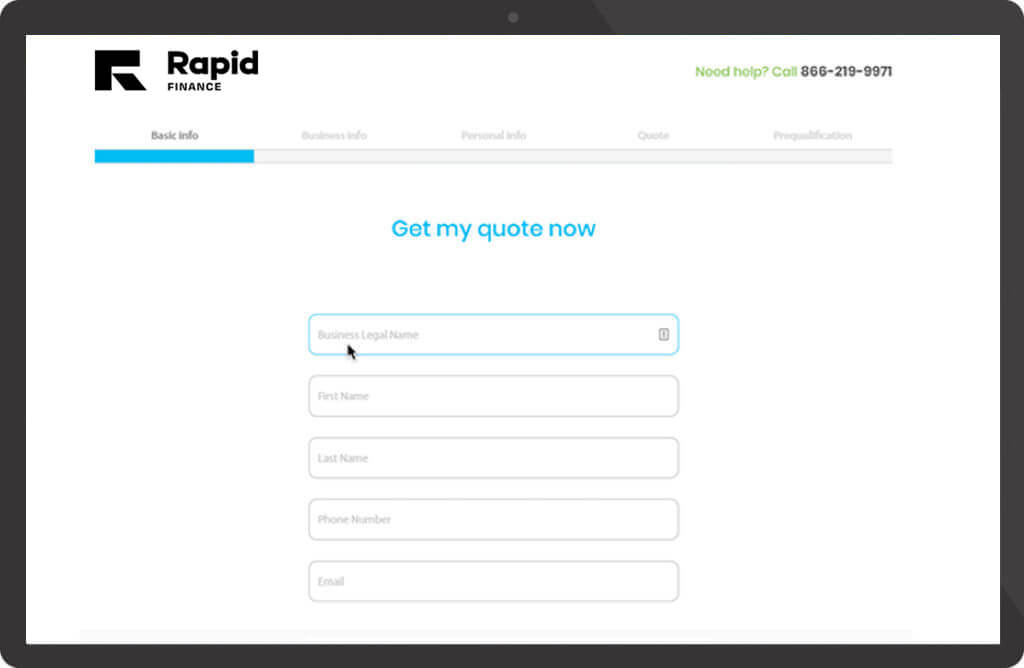

Application Process

Visit our online portal to fill out an application. Tell us about your company, goals, and objectives. We recommend having the necessary paperwork on hand to make the process even faster.

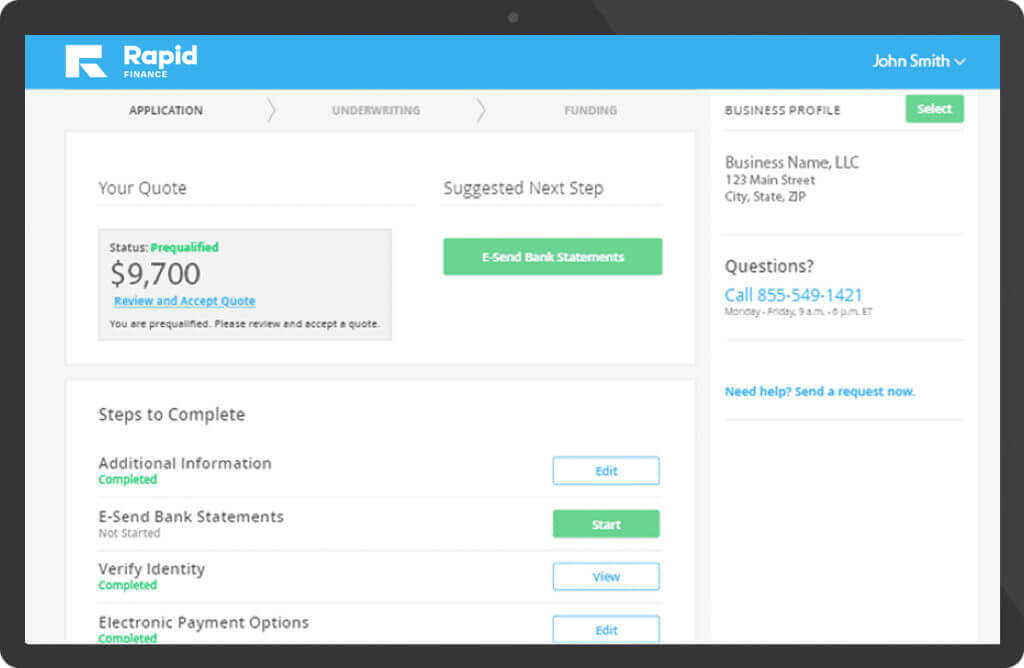

Our team will carefully review your business financing application. One of our trusted business advisors will reach out if we need any additional information.

Our team will send the approved initial draw to your business bank account if approved.

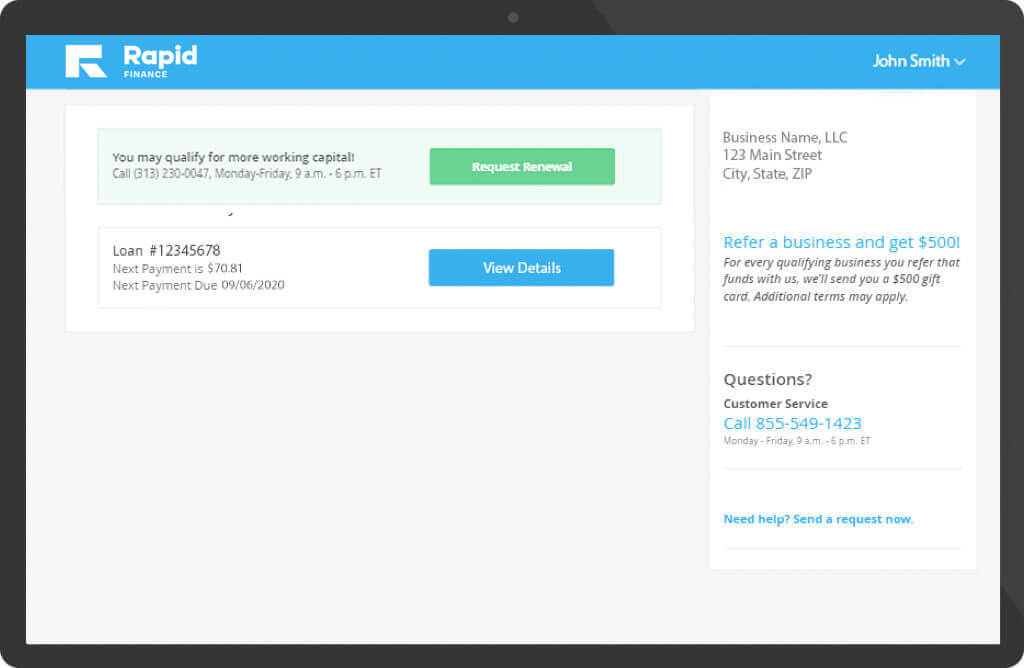

When ready, come back and draw on your businesses line of credit up to the approved amount.

Line of Credit FAQs

The type of product that is ideal for your business depends on the need for capital, the desired repayment terms, and the amount of capital needed, among other business-related factors. A loan is ideal for businesses looking for traditional financing with a higher capital amount and potentially longer repayment terms.

A line of credit is ideal for businesses that have repeated cash flow needs. It can also be used for a variety of short-term needs, such as managing payroll or covering unexpected costs. A line of credit allows you to repeatedly draw on funds, up to the maximum credit amount approved, while making regular payments to pay off only what you’ve drawn and any associated fees or costs.

With a loan, the business needs to pay back the entirety of the loan including any associated interest charges or fixed fees.

Determining whether your business should apply for a line of credit or a business credit card depends on how much working capital your business is looking for, whether or not your business prefers to set terms and payments, or if your business is looking to get some perks.

A business credit card usually has a set credit limit which can be used at any time. Business credit cards also come with a set interest rate and monthly payments. Some even offer cash back. A business credit card could be useful if your business would rather get these additional perks.

A business line of credit can potentially have a higher credit limit depending on what the business is approved for. Lines of credit come with daily, weekly, or monthly payments and have set terms, which may reset on every draw. A line of credit is a great option for businesses that have repeat cash flow needs or want to have working capital ready for any opportunity. This product allows business owners flexible access to working capital.

Applying for a business line of credit at Rapid Finance is simple and our online application only takes minutes to complete. We’ll ask a few questions about your business and request additional information, such as the owner’s information, last three months of bank statements, verification of identity, business information, and a business checking account. If approved, your business will have access to draw on the approved line of credit through our online client portal.

A line of credit works by giving businesses access to working capital that they can use at any given time. The business is responsible for paying back the drawn amount and any associated interest or other fees. Automatic payments are withdrawn from the business bank account.

Amortization can be from 3–18 months and may reset every time the business draws more capital from the line of credit.

Your business can draw from its approved line of credit at any time. The amount drawn will be deposited into the business bank account. You can then use the funds for your desired business purpose.

Rapid Finance offers a line of credit calculator that can help calculate what your business may qualify for and what estimated payments might be.

Line of Credit with Rapid Finance

At Rapid Finance, we’re dedicated to finding you the perfect-fit financing solutions. We’ll talk you through the best options for long-term growth while providing your business with the resources it needs to come out on top!

- Trusted by over 30 thousand businesses around the country

- A dedicated team of business advisors to help you navigate the best financing options

- Easy access to additional funding needs

- Innovative digital technology that streamlines the financing process