A Bridge Loan is ideal for fast access to funds

Bridge loans are excellent for covering unexpected costs when waiting on long-term financing.

What Is a Bridge Loan?

Fixed Payments

Payments are automatically withdrawn from the business bank account

Bridge Loan Term Options*

Loan terms start at 3 months and range up to 5 years

Cost and Fees*

An interest charge or fixed fee will be charged (other fees may apply)

A bridge loan is a short-term loan that helps bridge the gap between a business’s current need for financing while they wait for a more long-term solution to be secured. This is ideal for businesses who need to leverage funding to buy real estate, expand operations, or manage cash flow, among other reasons.

We understand that sometimes the loan process can take time and securing long-term financing can be an extensive process. That’s why at Rapid Finance, we work with our network of partners to provide small businesses with simple and transparent bridge loans, giving them access to the capital they need fast.

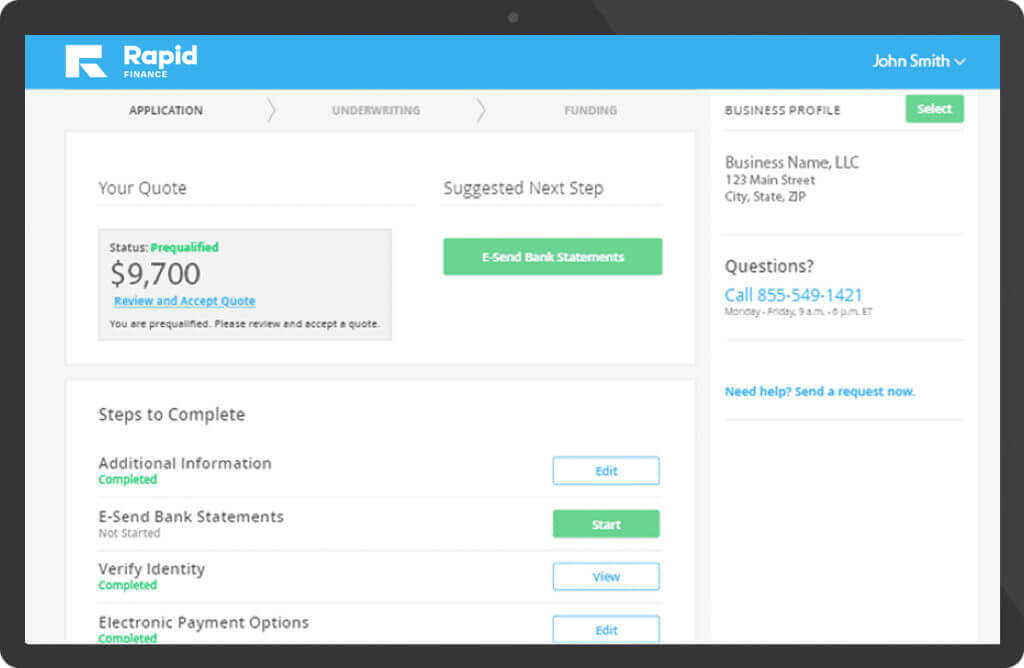

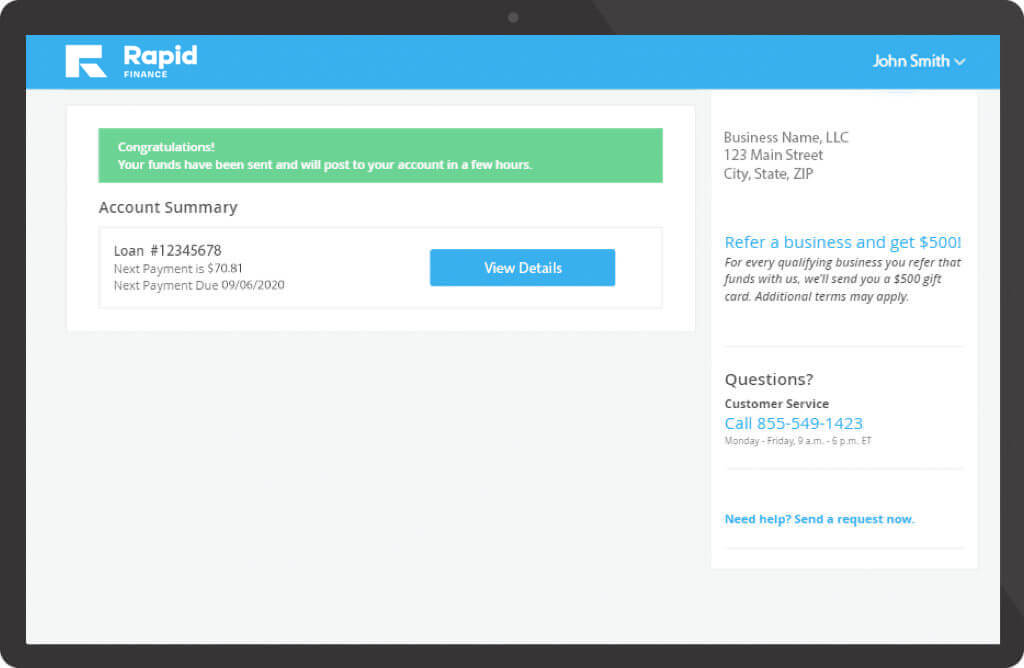

Our bridge loans start at $5,001 and range up to $1 million. Payment options are super flexible with automatic daily, weekly, or monthly payments*. Another great feature is that you can apply through our online portal. If approved, this portal will be available to you at any time, so you can always review your account.

Bridge Loans Allow Access to Funds While Your Business Secures Long-Term Financing

You need 3 important things to apply.

A valid form of identification

Business bank account number and routing

Last three months of business bank statements

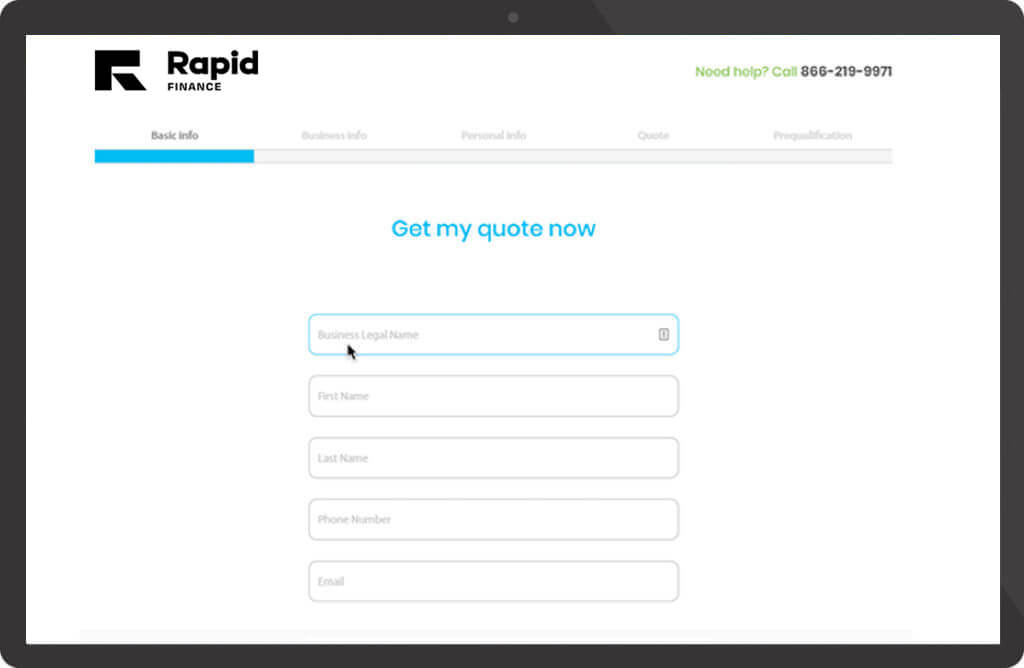

Application Process

Visit our online portal to fill out an application. Tell us about your company, goals, and objectives. We recommend having the necessary paperwork on hand to make the process even faster.

Our team will carefully review your business application. One of our trusted business advisors will reach out if we need any additional information.

Our team will send out the approved funds to your business bank account if approved.

Bridge Loan FAQs

A bridge loan works by providing businesses access to a fast influx of working capital while the business attempts to secure permanent financing. This gives businesses access to a lump sum of funds during the gap between applying and getting approved for a long-term loan.

Similar to a small business loan, businesses may benefit from receiving funds in a lump sum with fixed payments and terms. The main difference is that a bridge loan is considered a short-term loan, while a small business loan is typically long-term.

The Rapid Finance bridge loan calculator lets you select your desired working capital amount, credit score, and monthly sales and see an estimate of what your business may qualify for depending on the information provided. Additional information may be required.

No. Getting a bridge loan is very similar to getting a small business loan. Most business financing companies have requirements that must be met, such as a business bank account, time in business, business revenue, and a valid form of identification to apply for a bridge loan.

A bridge loan can be great for businesses that need quick access to capital while securing a long-term loan. They also offer quick access to capital, flexible payments, and terms ranging from 3 months up to 60 months. *

However, bridge loans are short-term. This might not be the best option for a business looking for a longer-term loan that spans several years. (Learn more about at Rapid Finance’s long-term small business loans.)

Having low or bad credit does not automatically mean your application for a commercial bridge loan will be denied. Most small business funders consider credit when reviewing applications, however, it’s not the only determining factor. There are many other factors business funders take into consideration when deciding to approve an application, including business revenue, time in business, accounts receivables, and business credit history.

Before applying there are a few things to keep in mind. The first should be the reason why your business needs the loan. You should also consider how much working capital your business needs and the repayment terms you can afford. This will help you navigate whether you need a long-term or short-term loan.

Other things to keep in mind before applying are what your business’ current credit score situation is, how fast your business needs the funds, if your business has been in operation for over two years, or if you have over a year of business bank statements, etc. These will be some of the questions asked during the application process.

Bridge Loans With Rapid Finance

At Rapid Finance, we’re dedicated to the continued success of each of our clients. It’s simple, we’re here to enable small businesses access to capital when they need it most. We make sure we provide your business with the resources it needs for long-term growth.

- Trusted by over 30 thousand businesses around the country

- A simple application process that allows your business to apply from almost anywhere

- Team of talented business advisors dedicated to providing your business with quick and reliable funding information

- A streamlined process for additional funding needs