Whether your small business is facing financial hardships or it’s just the right time to expand, the key ingredient most companies are missing to help grow their business is working capital. Luckily, many alternative business funding options can help small businesses grow out of financial hardships and expand.

We’ve compiled a list of the top alternative business funding options that your small business can take advantage of to help grow your business now.

Table of Contents

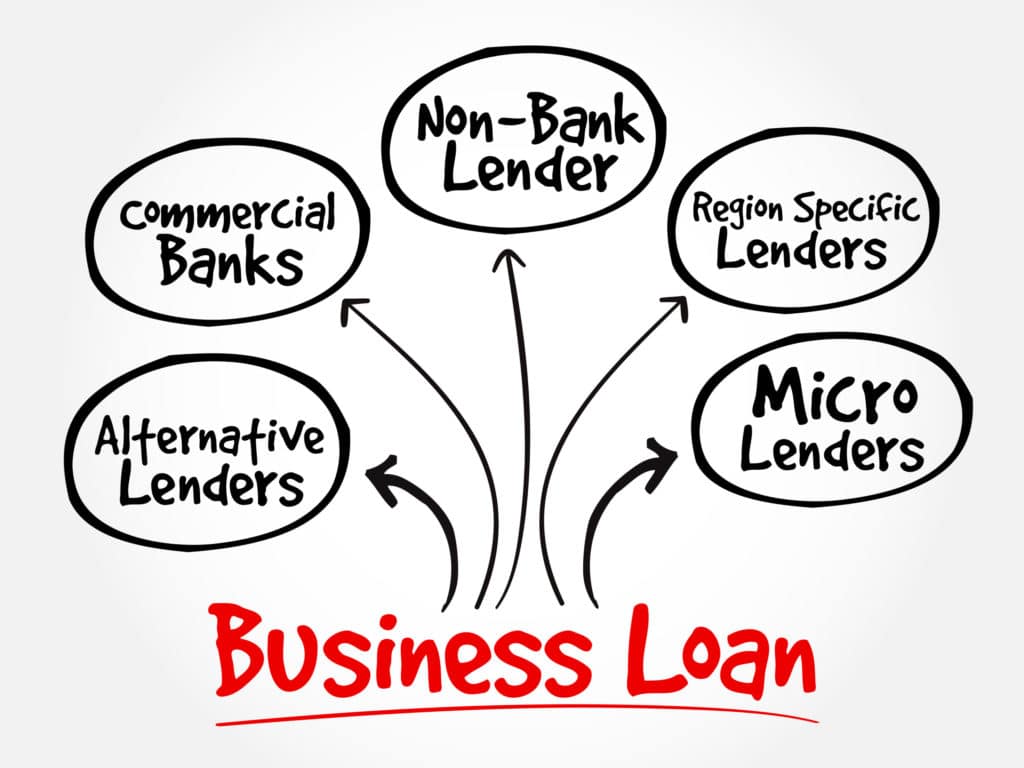

What Is Alternative Financing?

Alternative financing refers to any small business loan, advance, or another type of commercial financing available through alternative funders and financing companies for businesses that do not meet the requirements of a traditional business loan through banking institutions.

Alternative financing companies can provide more flexible business financing options to help small businesses access the working capital they need. Keep in mind alternative financing companies can offer both unsecured business loans as well as secured business loans.

What is an Alternative Funder?

Just as the name sounds, an alternative funder or financing provider is an alternative funding option for businesses when they can’t get approved for a traditional bank loan.

These companies have various financing options available depending on the business’s qualifications, business needs, and term options. Unlike traditional banks, these financing companies are private and have specific processes for determining eligibility and approval.

Why do Business Owners Seek Financing from Alternative Funders?

There are a variety of reasons why a small business may need working capital from a private funder or financier. The obvious reason isn’t always that their bank didn’t approve them, as a lot of business owners prefer immediately applying through private funders instead.

The most common reason is to meet their business needs and receive access to working capital much faster than they would through a bank.

Most of the time, small businesses need working capital to meet business expenses such as payroll, expansion fees, real estate, utilities, production costs, or even marketing expenses.

Other businesses may not have had a good year or quarter and need working capital to keep the business afloat while they try to increase sales.

Who is a Good Candidate for Alternative Funding?

Traditional funders look at various aspects of your small business such as:

- Financial history

- Time in business

- Overall business plan

This makes traditional funding difficult for many small businesses.

The best candidates for alternative funding solutions are businesses that can show a viable means of payment but might not qualify under a traditional funder’s stringent requirements or like how easy it is to apply with an alternative funder.

Specific Requirements Needed for Alternative Funding

Traditional funders prefer personal credit scores of 700 or above, annual revenues in the hundreds of thousands, and multiple years in business. Alternative funders, on the other hand, may be more lenient.

The minimum requirements of most alternative small business financing providers are:

- Personal credit scores of at least 600

- Some may even accept 500 and above

- At least one year in business

- Around $100,000 in revenue annually

- Some may accept as low as $60,000

- Enough ongoing cash flow to prove repayment ability

Even if your credit isn’t perfect, there are financing options available for your business.

Alternative Funding and Financing Options to Consider

There are many factors your business should take into consideration when deciding which financing options are best suited for your company. For example, will the repayment term be short or long, will your business need collateral, and will your business need a set amount of capital available to withdraw at any time?

Here is a list of different types of financing options that small businesses should further investigate to best match business needs.

1. Short-Term Loans

Small business loans are an excellent option for businesses that need quick access to working capital.

Term loans are financing options that provide companies with a lump sum of working capital with set payment amounts and dates. Once approved, the funds will be deposited into a business bank account for immediate use. Short-term loans typically have less strict requirements and simpler approval processes.

2. Line of Credit

If a business needs a set amount of capital available to withdraw at any given time, then a line of credit may be the right option. A small business line of credit allows your business to draw on funds up to an approved credit amount while making regular payments to pay off what was drawn. Unlike traditional loans, a line of credit allows continuous and repeated access to funds.

3. Merchant Cash Advance

A merchant cash advance is a short-term business financing option that provides businesses with working capital immediately in exchange for a percentage of the business’s future credit/debit card receivables.

Something to note for merchant cash advances is that your company must be able to accept credit card processing as a form of payment from clients.

4. Asset-Based Loan

An asset-based loan allows small businesses to access working capital using assets as collateral. This can allow small businesses to receive lower rates because the loan is secured with business assets. The more liquid the asset, the safer the loan will be.

5. Invoice Factoring

Invoice factoring is a type of financing where a business sells its invoices at a discounted price for immediate access to working capital.

It can take anywhere from 30 to 90 days for most businesses to receive payments from their customers, in these cases, invoice factoring gives small businesses quick access to funds to meet their cash flow needs.

How to Apply for Alternative Funding with Rapid Finance

The application processes for alternative funders/financing companies can vary, but they all have a few things in common such as requiring your business to submit certain documents.

Required Documents:

- A valid form of identification

- Business bank account number and routing

- Last three months of business bank statements

Application Process:

Apply Online

Start your business application and tell us about your company, goals, and objectives. We recommend having the necessary paperwork on hand. (i.e. driver’s license or passport, business bank statements).

Review

Our team will carefully review your business financing application, and one of our trusted business advisors will reach out if we need any additional information.

Get Funded

If approved, our team will send your business’ funds to the business bank account provided. This can be as quick as a few minutes, so be on the lookout!

Summary & Conclusion

If your small business is looking for flexible alternative business funding options that have: fast approval times, simple applications, and short-term options, these financing solutions could be an excellent choice for your business.