A fast approach to business financing

Business funding made fast and simple.

Get a quote in minutes!

A fast approach to business financing

Business funding made fast and simple.

Get a quote in minutes!

Quick Funding

Within hours of approval

$3 Billion+

Funded across various industries

Flexible Payments

Automatic payments

tailored to your business needs

A+ Rating from the better business bureau and 5.0 on TrustPilot

Business Funds to Meet Your Needs

Growing a business isn’t an easy task, that’s why Rapid Finance offers flexible financing solutions to help fit your business’ unique needs. At Rapid Finance, we specialize in fast, simple, and trusted business financing.

Our financing options enable small businesses to access working capital when they need it most. We are 100% committed to the long-term growth of your business.

- Working Capital

- Location Expansion

- Technology Update

- Equipment Leasing

- Marketing Solutions

- Debt Consolidation

Business Financing Solutions

Custom financing solutions for your small business.

Line of Credit*

- Funds starting at $5,001 to $250,000

- Terms up to 18 months

- Approved amount accessed anytime

- Weekly payments

Small Business Loans*

- Loans up to $1 million

- Funding as fast as 24 hours

- Terms ranging from 3 months to 60 months

- Automatic daily or weekly payments

Merchant Cash Advance*

- Advance up to $500,000

- Funding as fast as 24 hours

- Easy, fast application

- Flexible payments based on receivables

Bridge Loan*

- Loan amount starting at $5,001 up to $1million

- Terms up to 60 months

- Automatic payments

- Fast and easy application process

SBA Loan*

- Loans ranging from $500 to $5.5 million

- Terms up to 30 years

- Automatic monthly payments

- Partially backed by the government for business purposes

Invoice Factoring*

- Advance starting at $20,000 up to $10million

- Terms ranging up to 18 months

- Easy online application

- Turn pending invoices into immediate funds

Asset Based Loans*

- Based on company assets

- Terms starting at $50,000 up to $10million

- Terms ranging from 6 months to 36 months

- Fixed daily, weekly or monthly payments

Let’s See If We Match

Apply now to see how much working capital your business may qualify for in just a few minutes, with no obligation or risk to your credit profile.

My credit is...

My monthly sales volume is around...

How much could I qualify for?

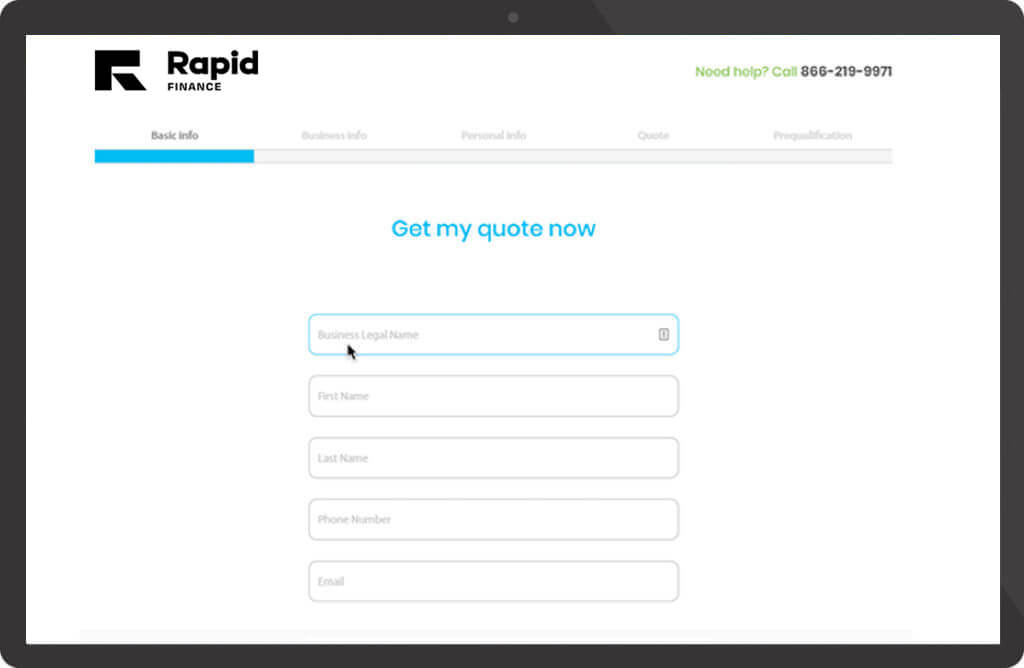

Owning a business may not always be simple—but applying with us is.

Apply in a few minutes, receive funds in a few days

Apply online or give us a call. We will need three months of business bank statements, your business tax ID, and your completed business application to get started!

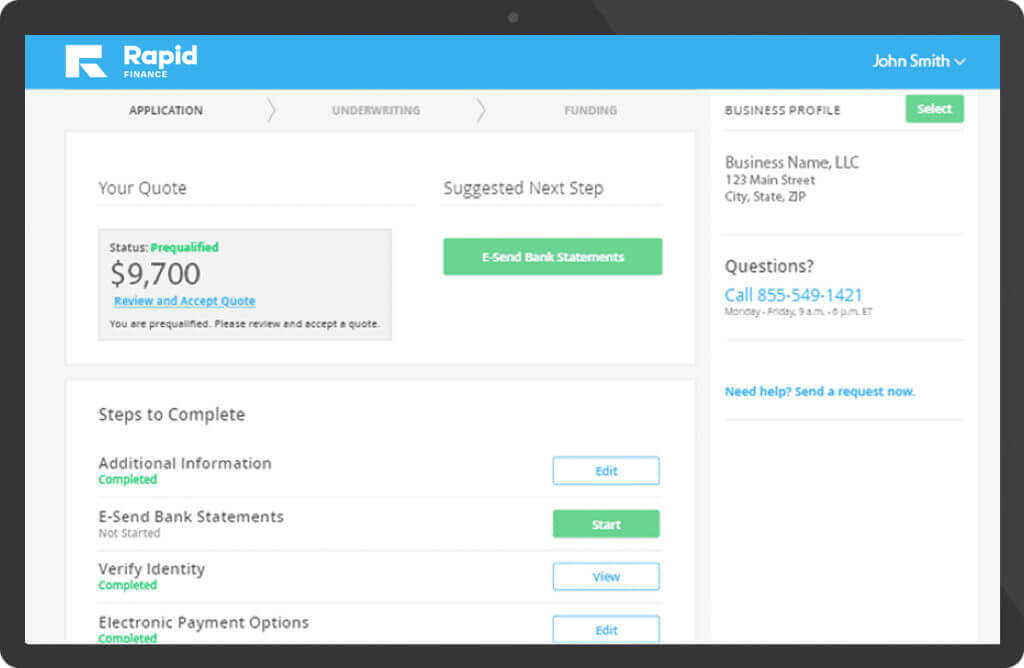

Review your business financing options online or call one of our Business Advisors to help you choose the best fit for your business’ unique needs.

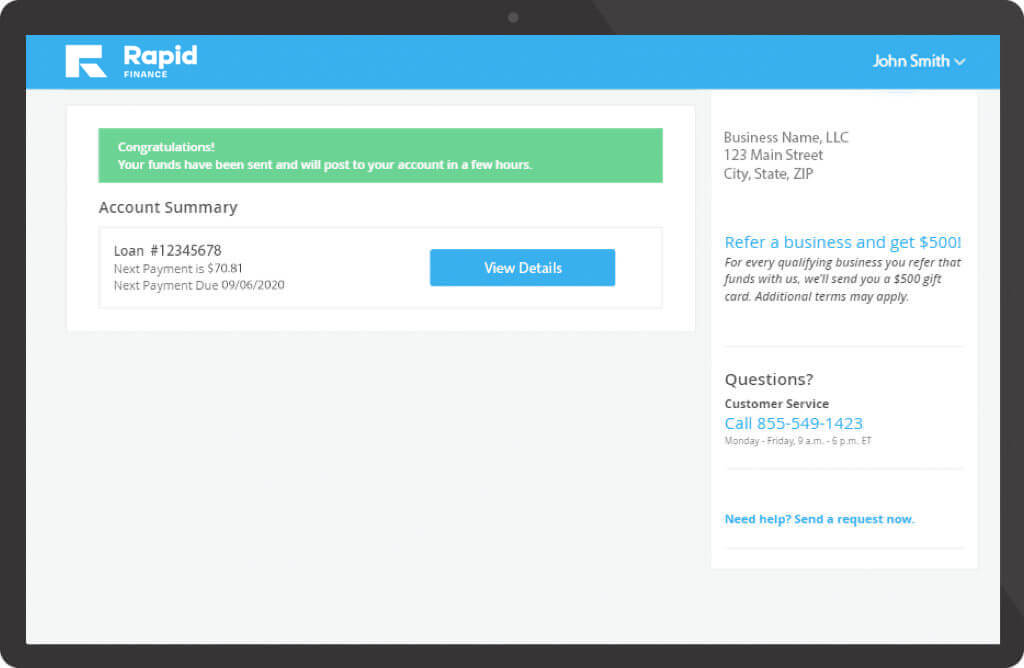

After choosing your custom business financing solution and getting approved, our team may send the funds to the business bank account on file within hours.

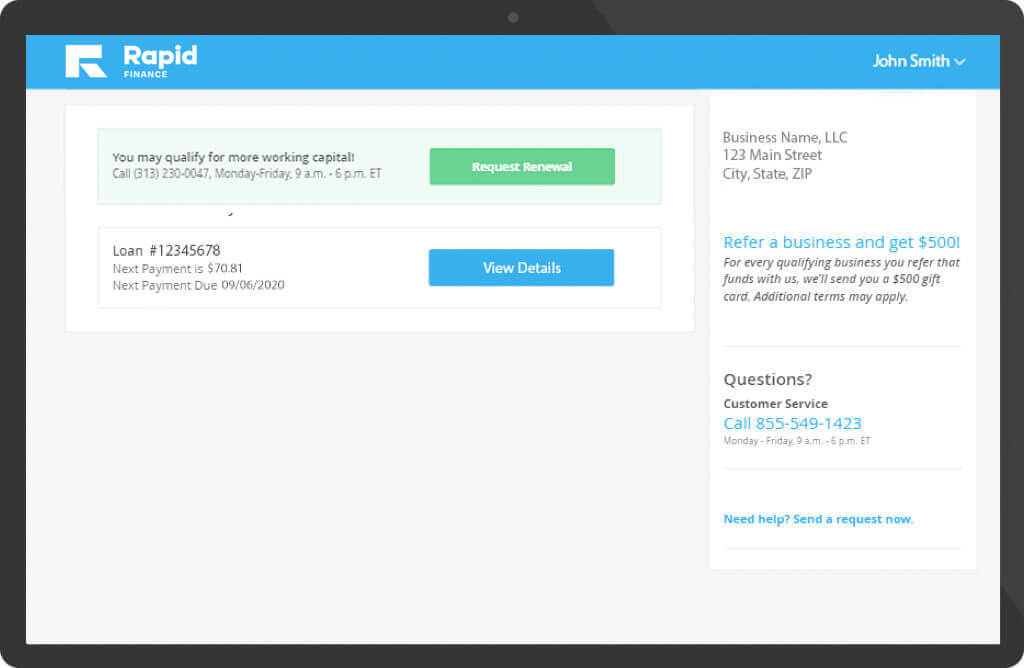

Give us a call for all your business’ future financing needs. At Rapid Finance, we’re always looking for new ways to help your business grow.

Why Businesses Love Us

At Rapid Finance we’re devoted to helping small businesses gain access to working capital when they need it most. We know that there’s no such thing as one-size-fits-all when it comes to small business financing, which is why we’ve created custom funding solutions for all your working capital needs. From small business loans to merchant cash advances and lines of credit, our financing is always fast and simple.

We understand how important it is to get funding from a partner your business can trust. That’s why our team is committed to building relationships with all our clients and partners and helping your business navigate the entire funding journey from approval to pay-off, so you can focus on what matters most—your business.

Transparent Quotes

Working with us means no hidden fees and no surprises.

Trusted Network of Partners

We work with partners around the country to help ensure businesses have access to the cash flow they need when they need it most.

Easy-to-Use Client Portal

We provide up-to-date digital financing technology that makes securing working capital easier and faster.

CLIENT TESTIMONIALS

Live Feedback From Clients Just Like You